When it comes to disruption, Clayton Christianson’s definition was the bottom-of-the-market disruption that replaces top competitors and moves relentlessly upwards.

We’re seeing the word disruption substituted for any type of dislocation within a market where technology comes in, and we’re seeing different types of market disruptions or dislocations change the common usage of that.

Step Change shares the same point of view on disruption with Tony Seba. He looks at how major trends — artificial intelligence, the electric engine, the shift away from carbon fossil fuels — are going to fit to just about every industry, every business over the next ten years.

As Bill Gates said, “If we massively overestimate the changes in the next two years, we massively underestimate the changes in the next ten.”

So if you move forward within the next ten years within your business, affectively, we do not start from a proposition of “Will disruption come?” but “Disruption is coming, what’s our response?”

The Step Change view is you’ve got the choice of three strategies:

- Be the disruption. How do we see the technology play to displace major competitors at the top of the tree? Therefore, the question is, how do we resource it and support it within our current organisation.

- Bridge the disruption. Most organisations need to get to where they are versus the revenue systems change within their business. How do we source that and keep it cash-flow positive? Transition and growth both start cash. How do we make sure we stay cash-flow positive in the transition phase.

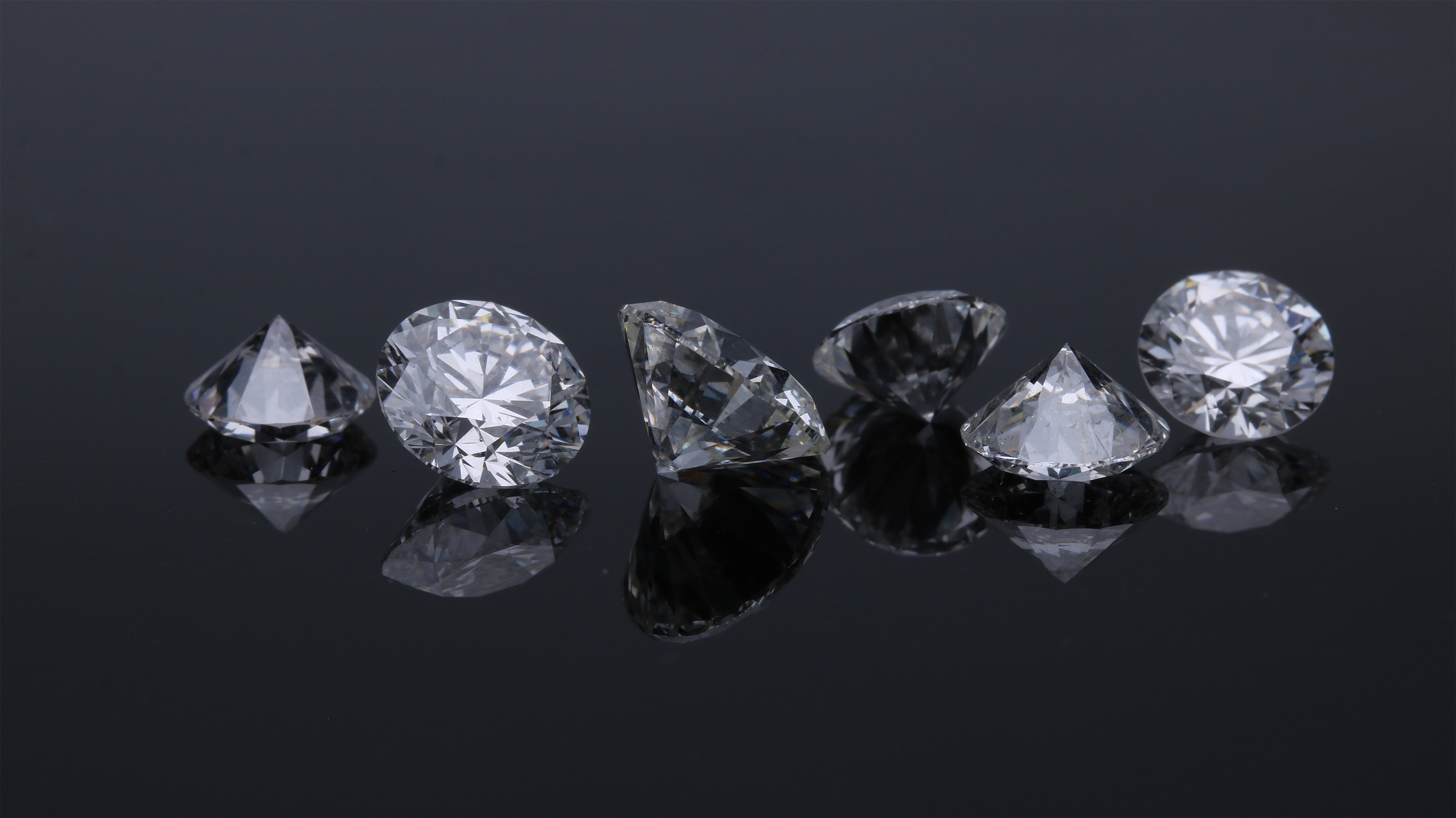

- Avoid the disruption. If disruption is coming, how do we find high-value, defendable niches now that we can stake out? For every disruption, there’s a counterpoint. It’s never markets move entirely; there is always sub-niches within there. If we can identify high-value niches now and stake them out, then we can effectively avoid it.