The economic downturn and increasing digital disruption has led to some businesses and industries folding. We use the Step Change strategic lens to explore what businesses in a sunset industry can do to rise above.

Insight: Some industries are on a decline due to the country’s slowing economic growth, evolving customer preferences, and digital disruption.

Data: According to the Australian Securities and Investments Commission, the number of companies entering external administration increased by a staggering 11.2 per cent last year. (ABC)

What’s the step change: Ask the right questions to help you identify where the value is either in your existing category or in other adjacent categories.

Sunrise and Sunset Industries in Australia

A sunset industry is an industry in decline. These are industries that have reached a level of maturity where there are existing and established players, protocols, and value delivery, leading to the loss of organic growth.

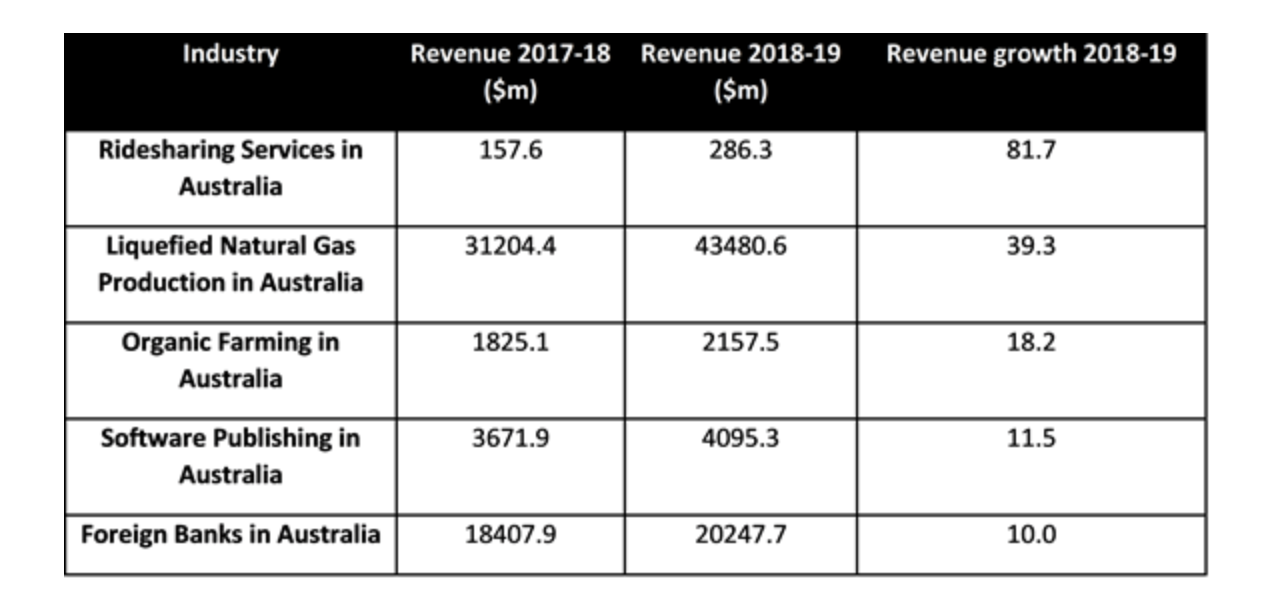

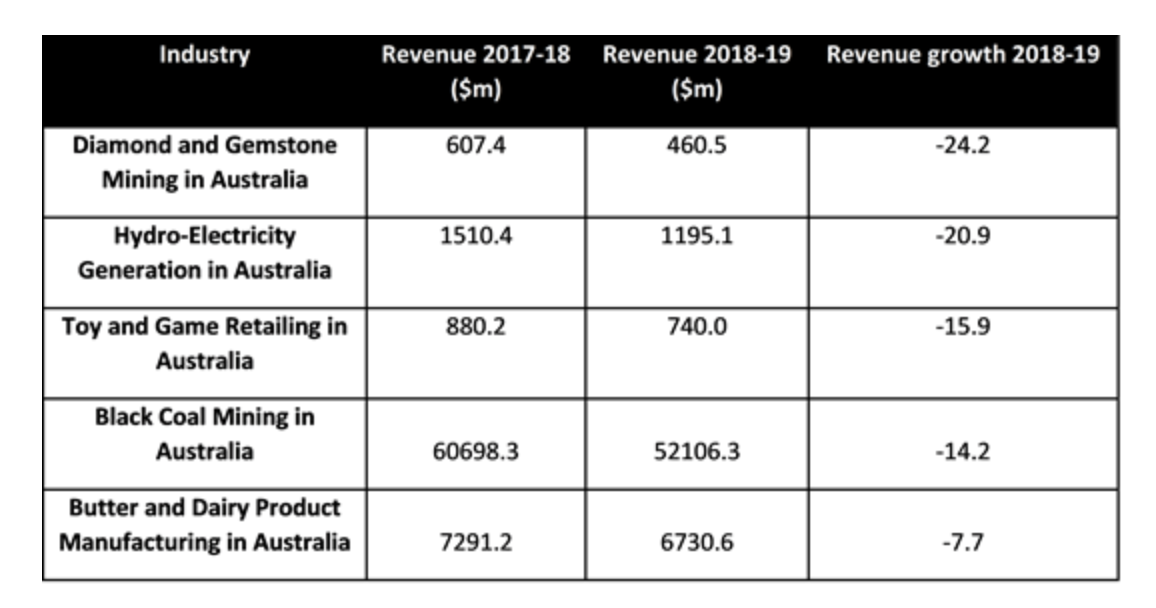

According to a report by IBISWorld, these are the declining and rising industries for 2018–2019 in Australia.

Rising Industries in 2018–2019

Ride-sharing services in Australia is expected to have the highest revenue growth out of all sunrise industries due to strong public demand. Australia’s growing smartphone sector and the entry of many international ride-sharing companies are also contributing factors in boosting the surge of users for ride-sharing apps and services along with decreasing deregulation of ride-sharing in 2018.

Declining Industries in 2018–2019

The Diamond and Gemstone Mining industries are expected to have the biggest decline in industry growth this year compared to its expected revenue in 2017–20118 with a –24.2 loss in revenue. This loss is expected from downturns and closures in the industry from Australia’s lack of any new resources to develop.

But is all hope lost for businesses in sunset industries? What strategies can they use to counter the challenges and thrive?

Running a Business in a Declining Industry

How do you ensure the continuity of your business in a declining industry?

While there are never any assured results in business, there are key points I want to share with you so you can adopt the right strategy and turn things around.

An American academic well-known for his theories on economics and business strategy named Michael Porter recommended companies to periodically go through a series of exercises that will help them identify the blindspots and explore all their options when they’re facing a period of financial decline.

Many of these businesses look for value in adjacent categories where it may be easier to compete, but it’s important to look into their existing category and determine if there is a way to compete for the remaining value in there and use the right strategy to win.

Michael Porter shared some key questions that can help gauge whether to proceed with a declining business:

- Is there a favourable structure for decline? Check whether you are still able to generate profit in spite of declining revenues. If your business is likely to completely disappear, then it may be time to reconsider.

- Is there a ‘cliff’ on the way out? What are the potential threats to be wary of?

- Can you compete for the remaining demand? Do you have a great brand that can help you compete for the remaining demand in your category successfully? Is there a way to compete for the existing value?

Sometimes, there could be an opportunity to consolidate within the industry. Check if you can retain the existing demand versus lower your cost of acquisition or your customer lifetime value and how you can compete.

Have a look at your existing customers: how can you serve them in a cost-effective way? How can you up the competition so it looks like you’re serving those customers in a different sector or category?

Dangerous Strategies to Avoid

More than sunset industries, businesses will encounter factors that can lead to losses, and many of these reasons are beyond their control — but some are completely avoidable.

When we dug deeper into those that could have been prevented, these were brought about by faulty strategies that did not reflect their current state or address their core problems.

According to Paul Carroll and Chunka Mui, there are seven ways to fail big. Below are some dangerous strategies that you’ll need to avoid.

The Synergy Mirage

In the quest for growth, some companies may opt to join forces with other businesses that may complement their strengths and needs. But this doesn’t always work out to the results expected.

In fact, up to 70-90% of mergers and acquisitions will most likely fail.

Many companies that failed missed to account for the complexity of mergers, especially when companies cater to different markets and audiences, have different business models, or strive for goals that are not fully in sync.

Think of what happened to the AOL-Time Warner merger. It crashed in 2009, citing conflicts in company culture and ambition. When you have two different companies with an entirely different set of priorities, it can be difficult to execute and bring visions to fruition.

Aggressive Financial Engineering Methods

Complex financial practices in businesses are difficult to manage. They can bring companies down when brands and reputation are on the line. When companies start to cut corners to increase profits from investors, the risk for fraud is staggering and can subject corporate officers to to fines and jail time.

Turning to Rollups

Rollups, or combining a dozen small businesses into a large company to promote a bigger brand, increase purchasing power. Lower capital costs may sound dreamy, but in reality, they are unlikely to deliver these results.

In fact, the actual costs may far outweigh the gains, leaving investors with no significant value at all.

Staying the Course

Everyone should have learned from Kodak by now that investing even more on your current strategy to adapt to the changing market can be disastrous.

Failing to consider all the possible options and ignoring all other threats to surge on can lead to costly results when other players decide to ride the change and end up taking the big market share.

Turning to Adjacent Markets

Many industry players think this is a logical move, but a lack of expertise in these markets can lead to misguided acquisitions and a failure to account for challenges that may rise with the competition.

Investing in the Wrong Technology

Many organisations believe that investing in technology is the solution to improve their processes, increase sales, and lead to better business. There are two crucial things to remember here: strategy and execution.

Investing in technology and new systems without the right strategy and proper execution can end up in big financial losses.

Consolidation

When industries mature, many companies may fold or decide to merge to reduce capacity, manage costs, and gain more purchasing or pricing power.

However, consolidation can be dangerous because you have the potential of buying problems along with assets. Systems that work well for a business may no longer hold up as companies get bigger leading to service breakdowns and even a greater loss in profits.

Diagnose by Asking the Right Questions

To diagnose the core problem, answer the following questions:

- What’s the root cause of decline?

- What are the likely and preferred futures?

- What’s the level of competition?

- What will happen to margin and value?

- Will margin decline commensurate with volume to have an inverse relationship? While the category itself may not be growing, there may be an opportunity to have a higher margin or the customers that remain so.

- Is there an M&A/roll-up approach that makes sense? Oftentimes, in this regard, this is a useful time to review this.

Recommended Strategies for Sunset Industries

In Strategy beyond the Hockey Stick from McKinsey, we learn that there might be an opportunity to be smarter about mergers and acquisitions in a programmatic sense.

A programmatic approach to M&A means instead of doing large deals, where it can be an all-in high-risk approach, you need to be building strength by building capability.

Below are strategies that can prove to be beneficial for industries in decline.

Niche

Be valuable, ownable, and defendable. Narrow down your target market. Instead of marketing to everyone, focus on satisfying a specific need in that certain demographic of people who could most benefit from your service or product.

Be Very Efficient and Streamlined

Become lean. This means understanding customer value, taking out what doesn’t offer value, and focusing your key processes to increase this value.

Lean organisations are more attuned to their customers’ needs and therefore are able to ensure that all their efforts are geared towards meeting these needs.

It’s been proven that successful lean organisations achieve an average of 90% reductions in lead time and 50% improvements in productivity, among other things.

Download our lean guide towards thinking lean.

Milk until Windup

Profit on the wind down. Have a wind-down plan that reduces with demand. Plot the winding back of your services so you can still be profitable even as demand decreases.

Dominance in Consolidation

Is there an M&A or rollup or joint venture approach that makes sense? Can you win with programmatic principles, change, and become the dominant consolidator?

Look for smaller M&A deals, which have been proven to yield great results. If you do one small acquisition a year for 10 years, you may end up with a third of your market capital being M&A-based.

Reimagine value and look for adjacent blue oceans

Taking inspiration from the blue ocean strategy. Look for adjacent markets with little or no competition. Seek to create a space where any competition for your products and services become irrelevant.

In a time where supply exceeds demand, looking for blue oceans or new spaces with uncontested market space is ideal. This allows you to create or capture new demand and raise buyer value.

Tying It Together

Although it can be challenging for sunset industries to rise above, all is not lost.

Ask yourself the right questions, explore all your options, be wary of the wrong strategy that have been proven to fail, and find what’s right for your specific industry from those we’ve mentioned above so you can equip your business with what you need to survive the or start anew.